As we navigate an ever-changing venture landscape, we wanted to share the latest trends and insights shaping U.S. Early-Stage, “Net New” Enterprise Technology. Alongside exciting developments in our portfolio, these insights provide a glimpse into where we see significant opportunities emerging in the near future.

View from the Top:

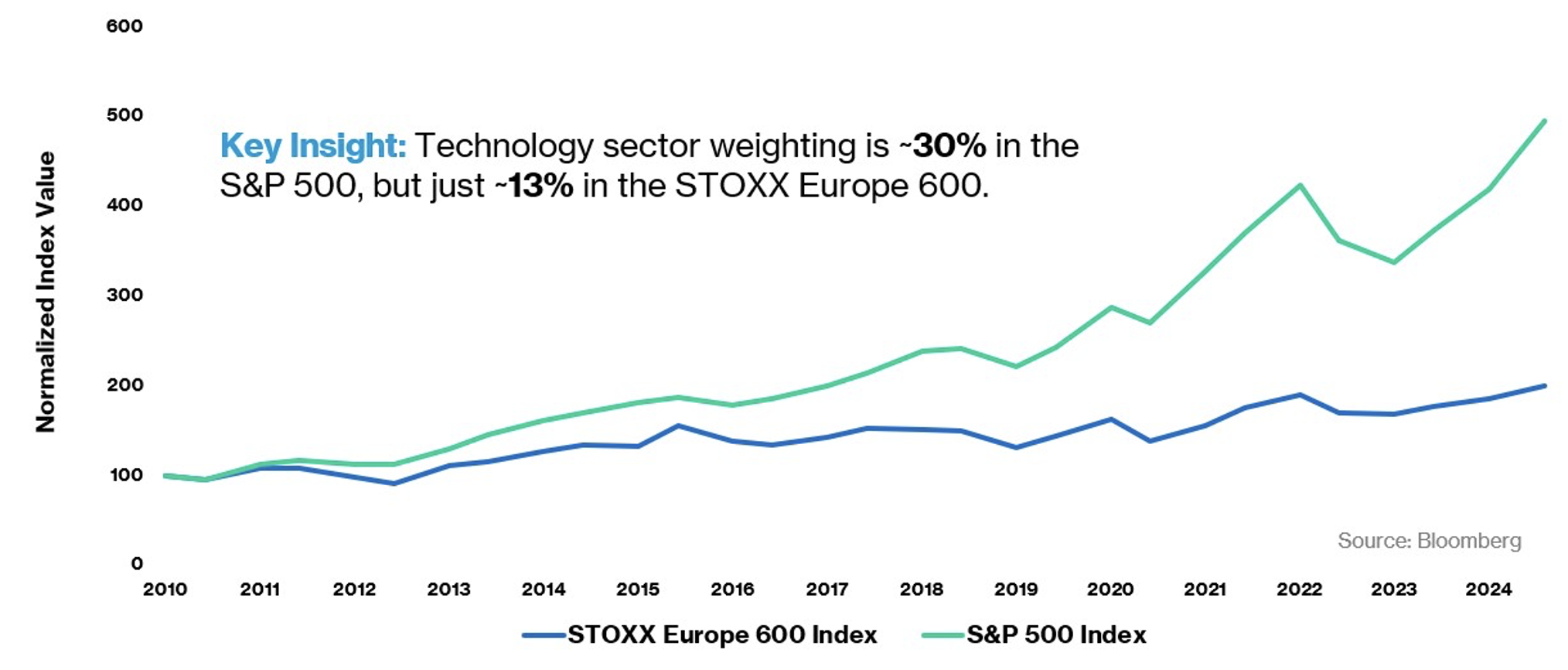

Normalized Performance Comparison: S&P 500 vs STOXX Euro 600 Index

- U.S. technology companies continue to drive outperformance, largely attributed to the heavy tech weighting in the S&P 500 compared to the STOXX Euro 600 (~30% vs ~13%).

But this dominance isn’t limited to the U.S. versus Europe. It’s global

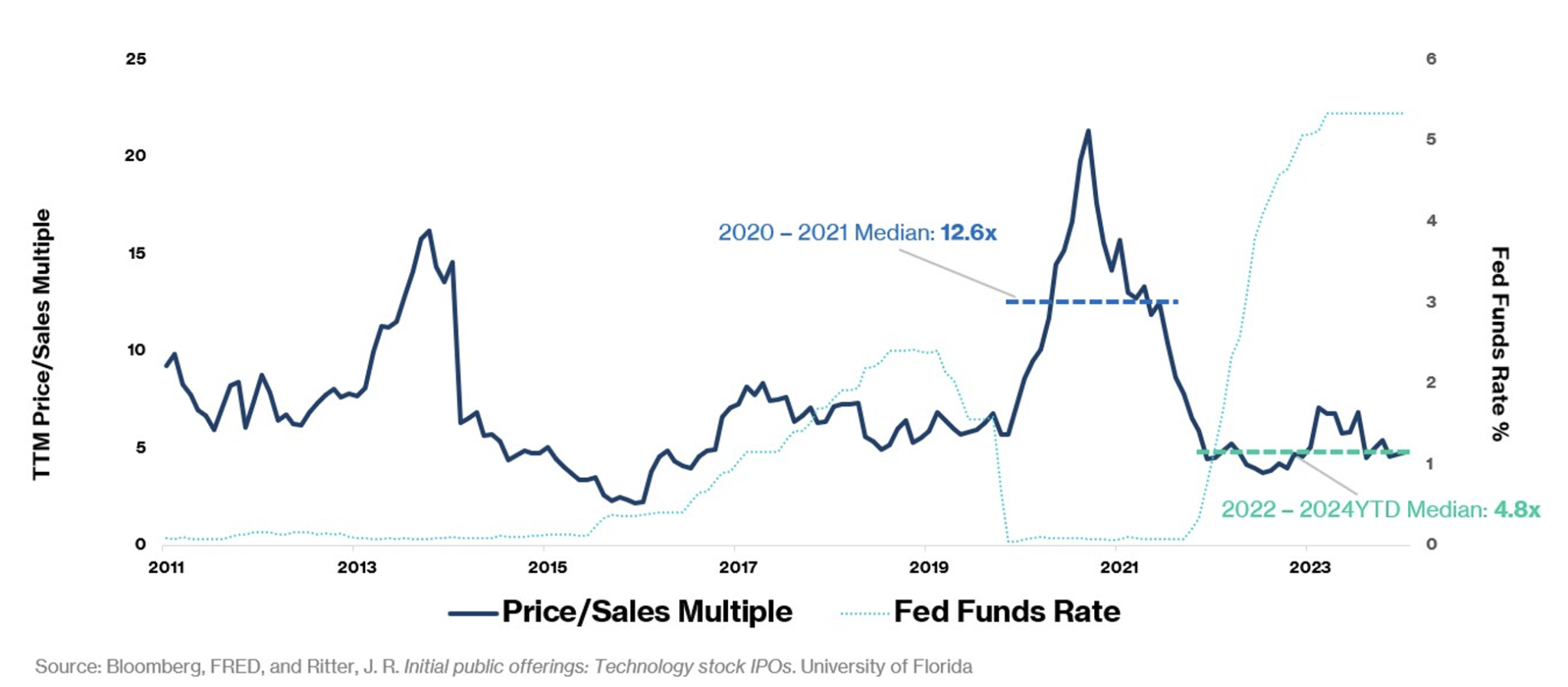

The growth premium, which commanded a 10:1 advantage over FCF margins in 2021, has rationalized to roughly 3:1.

As monetary conditions potentially ease, we expect an expansion of growth premiums, though likely not to ZIRP-era extremes. This would align with historical risk-asset behavior during periods of fed rate cuts.

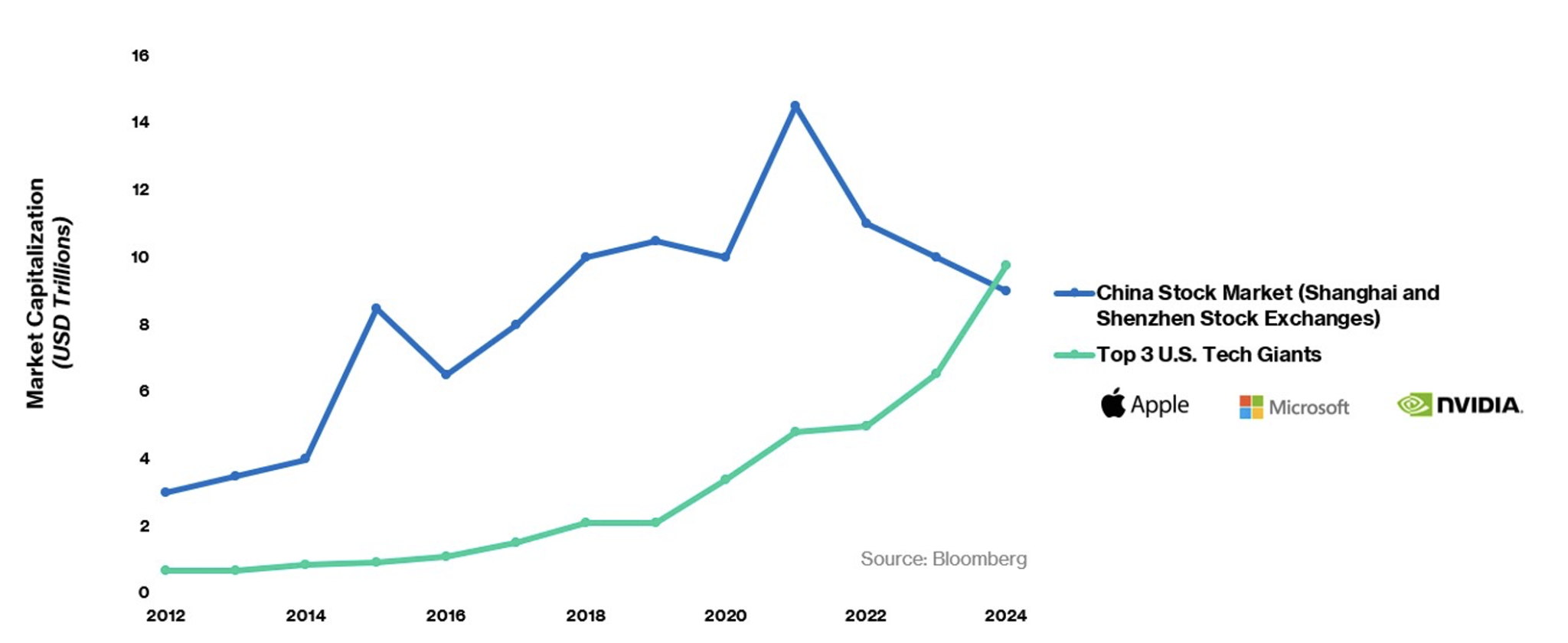

Market Cap Growth: China Stock Market vs. Top 3 U.S. Tech Giants

- Three of the “Magnificent 7” — Apple, Microsoft, and NVIDIA — have a combined market cap larger than the entire Shanghai and Shenzhen Stock Exchanges.

- Few could have imagined at inception that three early-stage U.S. venture-backed tech companies would disrupt and shape markets to the extent that they have.

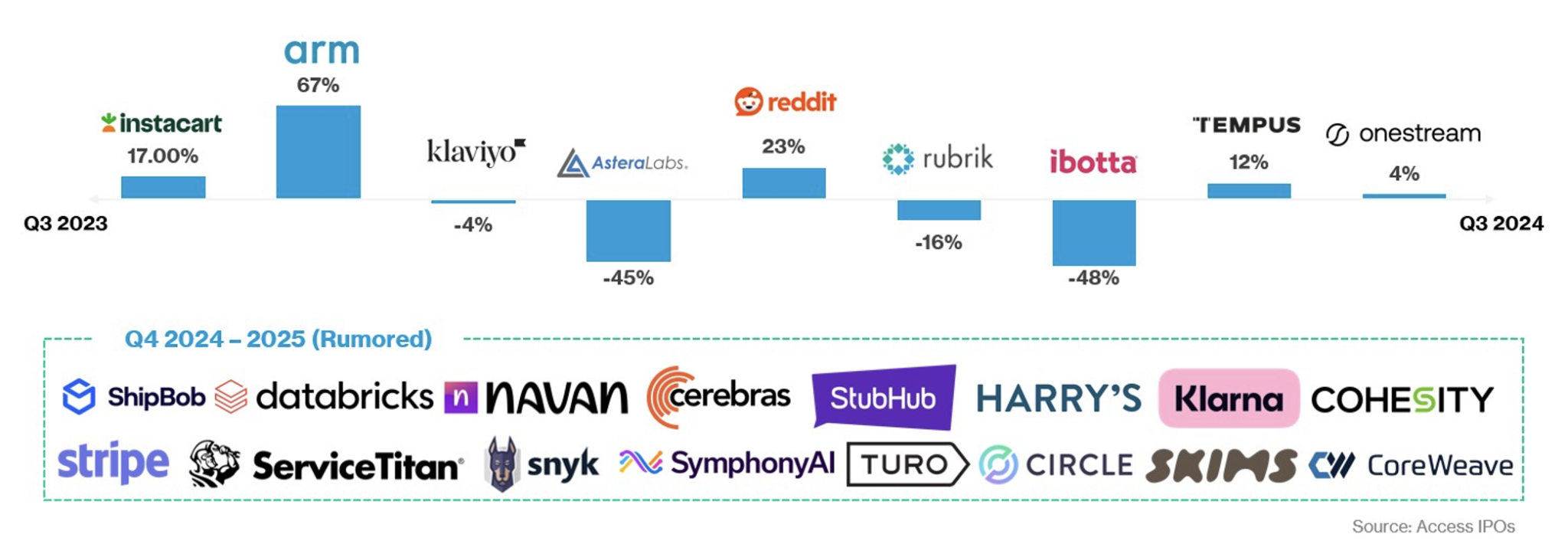

With public indices near all-time highs, the big question for venture LPs remains: When will the distributions start flowing? – We’ve been closely monitoring recent IPOs.

Testing the IPO Market: Recent IPO ITD Performance (Q3 2023 – Q3 2024)

- Early trading performance has been mixed.

- The pipeline/backlog of qualified/quality companies continues to grow.

- The IPO window is uncertain, but the real question is whether investors and founding teams are willing to go public at today’s multiples, which in most cases might be a haircut on their last growth round valuations.

TTM Price/Sales Multiple of VC Backed IPOs

- The multiples may be down from the peak, but they’re still close to the 10-year median.

Portfolio Company Milestones

Several companies from Fund I and Fund II have achieved notable milestones that we’re excited to share. We encourage you to explore these updates further:

Tenyx, a developer of AI-powered voice agents, has signed a definitive agreement to be acquired by Salesforce. This acquisition will integrate Tenyx’s expertise in voice AI with Salesforce Service Cloud, enhancing customer interactions by making them more intuitive and seamless. LEARN MORE >>

Rhombus secured $45M in Series C funding to extend the global footprint of its open, cloud-managed physical security platform. LEARN MORE >>

Elum Energy, a leading provider of advanced energy management solutions for renewable energy systems, has secured $13 million in Series B funding led by Energize Capital, with participation from existing investors Alter Equity and Cota Capital. This investment will support the company’s growth plans to address the booming global renewable market. LEARN MORE >>

Farther surpassed $3 billion in AUM and added 32 new strategic hires to bolster its wealth advisory capabilities and enhance its blend of technology with traditional wealth advisors. LEARN MORE >>

Qu POS continues modernizing the Quick Service and Fast Casual Restaurant industry by deploying its leading Unified Commerce Platform to prominent restaurant brands. Jack in the Box chose Qu’s Unified Commerce Platform for Jack in the Box and Del Taco across 2,800+ stores. Qu uses a data-driven foundational framework that reduces complexity while increasing speed and innovation. LEARN MORE >>

Emerging Net New Technologies

Liquid Cooling

At Cota, we’re constantly exploring the intersection of technology and its broader impact on industries. One area we’re particularly focused on is liquid cooling, as AI’s rapid evolution continues to push the limits of computational power and energy infrastructure.

Rather than being just another technological advancement, liquid cooling is emerging as a critical component in addressing the strain on the power grid and the overheating of data centers. As computational demands grow, energy efficiency could become the defining factor in AI’s ability to scale sustainably.

In our latest research, we’ve been diving deep into the potential of liquid cooling technologies to meet these challenges head-on and support the next wave of AI-driven growth. Read the full article here.

We would enjoy hearing your thoughts and feedback!

Warm regards,

Cota Capital Team