As we approach the end of 2024, we’re excited to share our latest analyses of trends and observations in U.S. Early-Stage, Net New Enterprise Technology. We encourage you to explore our key insights below, along with notable updates from our portfolio companies.

View from the Top: Key Trends and Insights

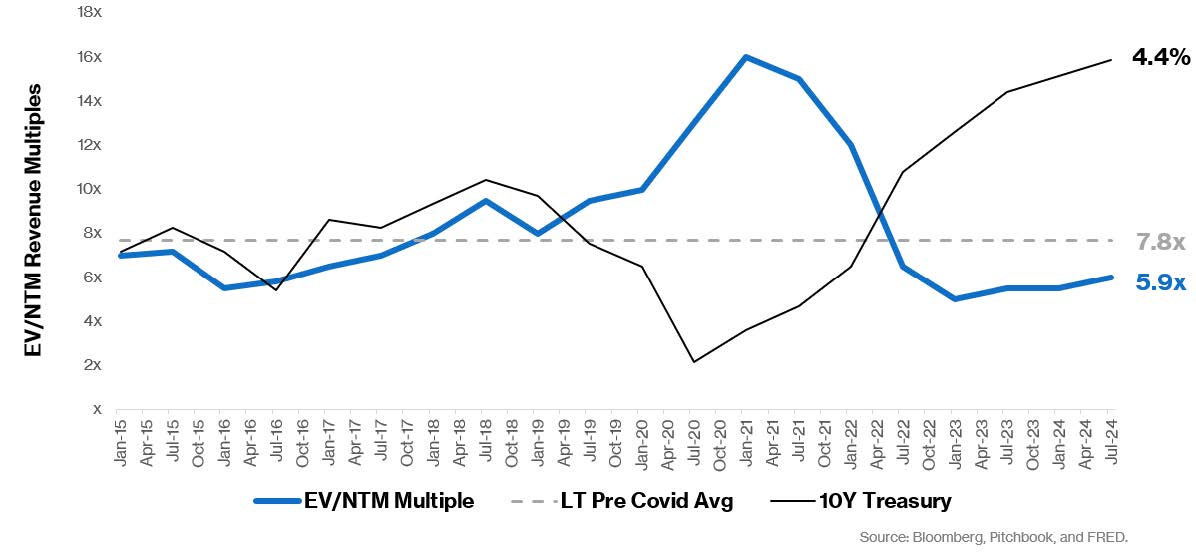

Normalization of Public SaaS Multiples

Public SaaS EV/NTM revenue multiples have normalized to 5.9x—below pre-pandemic levels of 7.8x and well off ZIRP-era peaks of ~17x. This compression reflects both higher cost of capital and a fundamental shift in growth valuation frameworks.

The growth premium, which commanded a 10:1 advantage over FCF margins in 2021, has rationalized to roughly 3:1.

As monetary conditions potentially ease, we expect an expansion of growth premiums, though likely not to ZIRP-era extremes. This would align with historical risk-asset behavior during periods of fed rate cuts.

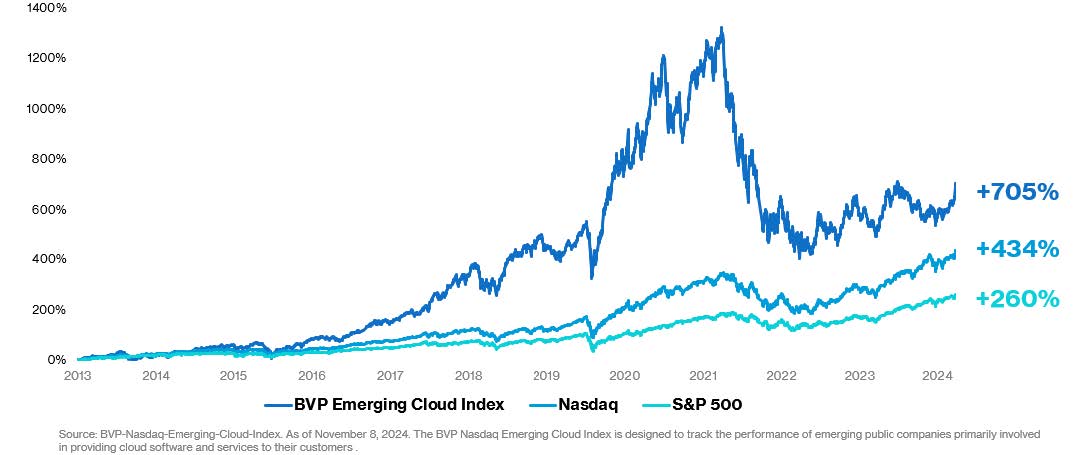

Cloud Software Companies Outperform

Despite normalization of SaaS, and zooming out just a bit, cloud software emerging public companies continue to outperform broader markets by a great margin, supported by:

- High-margin business models

- Hyper-scalability

- The ongoing digital transformation remains a top enterprise priority

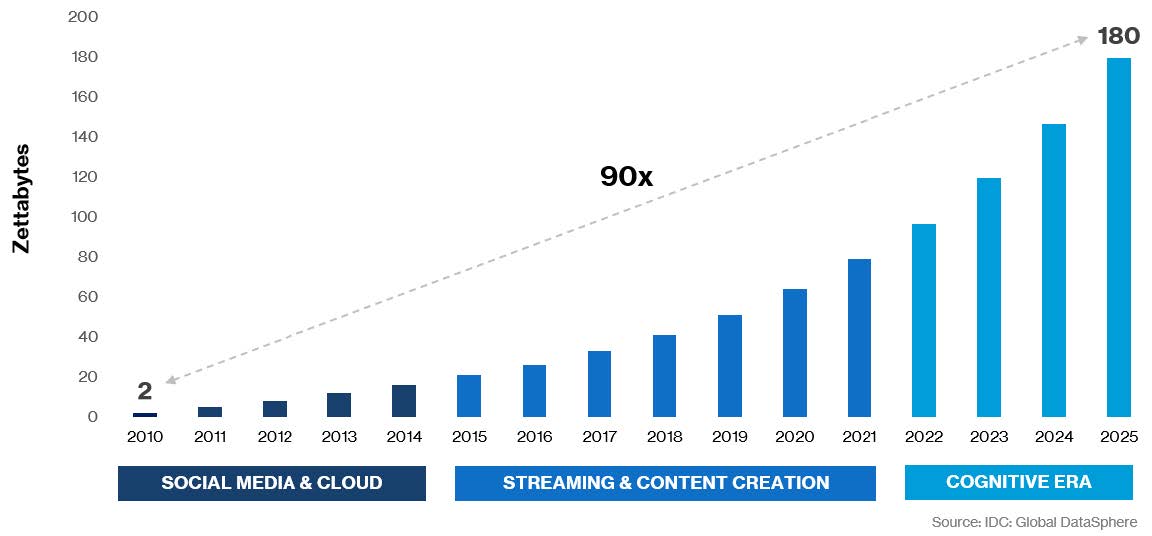

Data, Data, and More Data

More data has been created in the last 3 years than in human history:

- 90x Data Explosion: The projected leap from 2 to 180 zettabytes (2010-2025) has redefined the possibilities for AI advancement

- AI Systems learn from billions of daily social patterns and digital footprints – impossible in the early cloud era

- This unprecedented data environment enables more sophisticated AI models to emerge

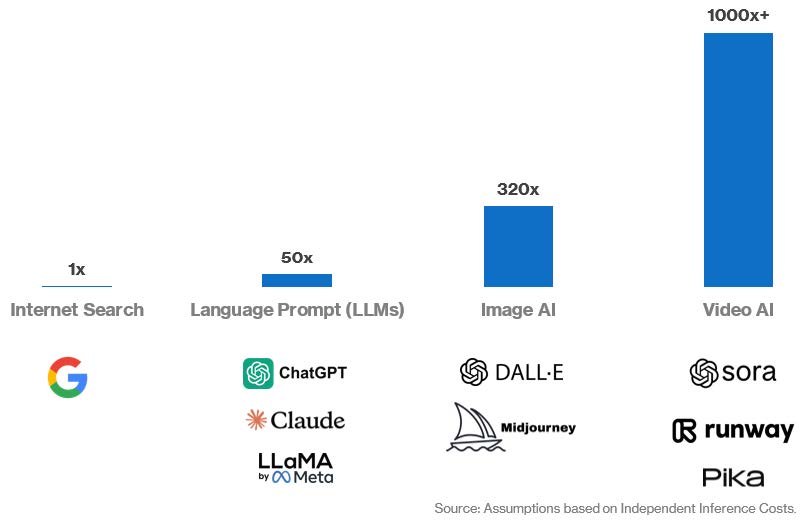

AI Compute Power Required vs. Google Search

The AI revolution comes with unprecedented computational demands. The chart above considers a Google search as the baseline unit of compute “1x”.

This exponential scaling of compute requirements across modalities illustrates why infrastructure capacity has become a critical bottleneck in AI deployment. As multimodal AI applications become standard, compute demand will increase.

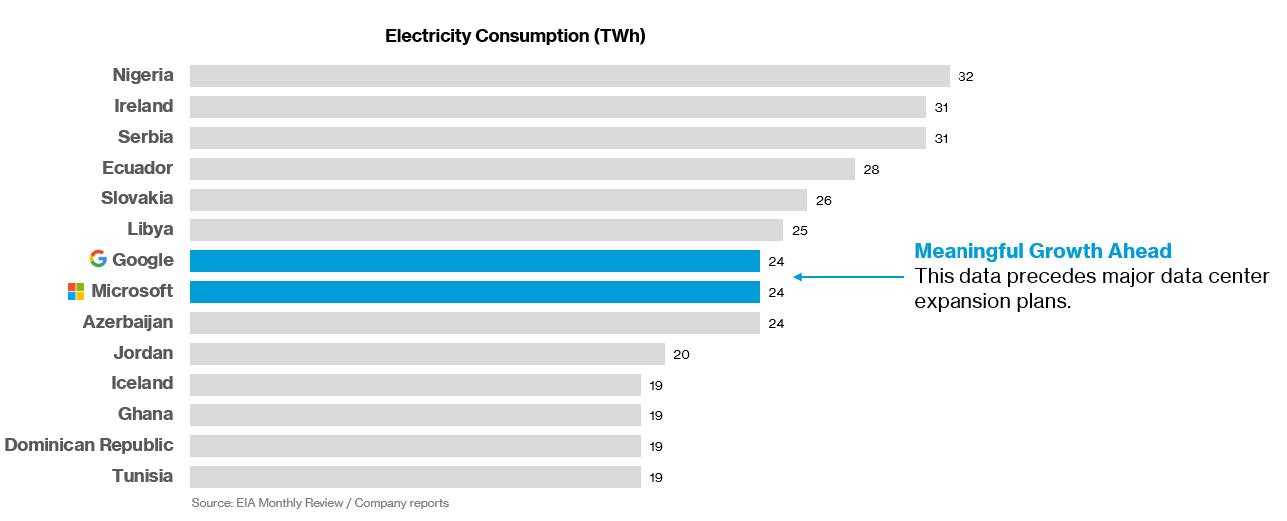

Energy Reality

The hyperscalers have been preparing for increased compute workloads. Their aggressive data center buildouts reflect preparation for AI’s massive infrastructure demands. Consider this: in 2023, Google and Microsoft each consumed more electricity than 100+ countries—and this was before their major AI-driven expansion plans.

At the current trajectory, data centers are expected to consume 10% of global electricity by 2050. This isn’t just a tech infrastructure story—it’s a fundamental reshaping of global energy demands.

Enterprise AI Opportunity

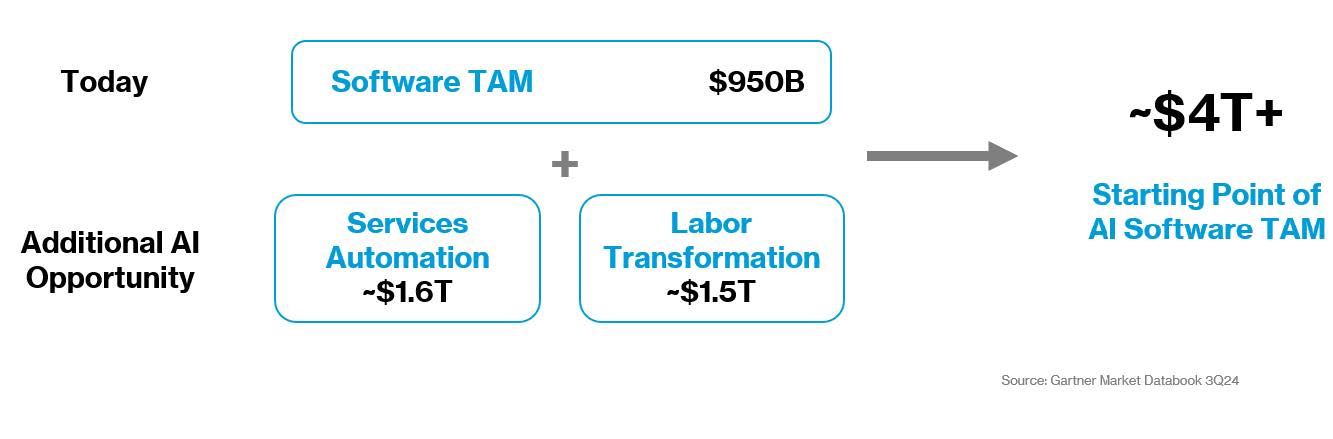

Tech Giants have placed their infrastructure bets—massive investments in data centers and GPUs signal their conviction. But the real question isn’t about the infrastructure buildout—it’s about the path to realizing AI revenue.

The Enterprise AI opportunity points to a starting TAM of $4T+, driven by the transformation of both services and labor markets by new technology.

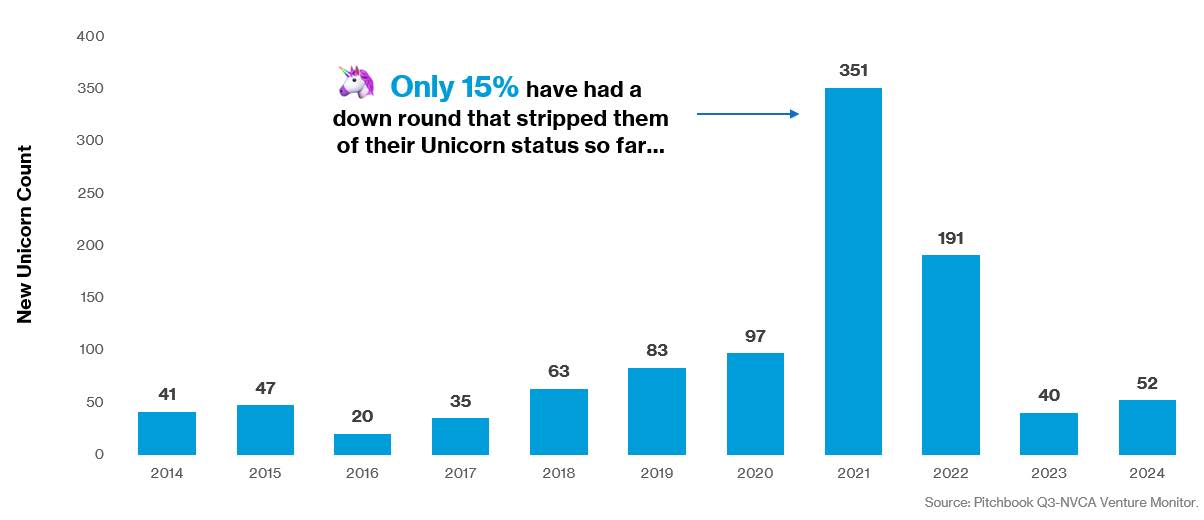

Unicorn Minting (per year)

The unicorn creation rate has normalized post-2021’s speculative frenzy. Yet the true unicorn unwind remains up in the air—only 15% of 2021’s unicorn cohort has faced a unicorn delisting (valuation adjustment that gave them a repriced valuation of less than $1B).

Looking to 2025, the narrative could shift positively. A growing pipeline of IPO-ready companies combined with improving market conditions could unlock much-needed liquidity. Meanwhile, strategic buyers are circling—setting the stage for accelerated M&A activity in the coming quarters.

Portfolio Company Milestones

Several Cota portfolio companies have achieved notable milestones that we’re excited to share. We encourage you to explore these updates further:

Farther secured $72 million Series C funding to expand its advisor network and enhance its custom-built wealth management platform. This funding round elevates Farther’s post-money valuation to $542 million and comes as Farther surpassed $5 billion in assets under management. LEARN MORE

Qu POS announced a strategic partnership with Golden Chick, one of the country’s fastest-growing quick-service restaurant chains. Leveraging Qu’s native products for in-store POS and kiosks, AI-driven kitchen display solutions (KDS), and direct delivery integrations, Golden Chick is poised to deliver a consistent, highly integrated ordering journey across its 230 locations. LEARN MORE >>

CAST AI announced a partnership with Hugging Face, the leading open-source platform for AI builders, to dramatically reduce the cost of deploying Large Language Models (LLMs) in the cloud. LEARN MORE >>

Simbian launched a suite of AI agents that work alongside security teams to enhance the intelligence, speed, and coverage of their security program. LEARN MORE >>

Emerging Net New Technologies

AI Tooling

At Cota, we’re constantly exploring the intersection of technology and its broader impact on industries. An area we’re particularly focused on is AI tooling. AI tools are crucial for supporting the entire AI lifecycle, from data preparation and model training to deployment and monitoring, enabling the creation of AI applications efficiently and effectively.

AI tooling presents Net New opportunities in tech. There is no clear reference architecture when it comes to AI tooling. Unlike traditional software development, there’s no established “best practice” for building, training, and implementing generative AI applications. This leaves significant room for startups to define new standards and create novel products. Read the full article here.

To learn more, please visit us at cotacapital.com.

We would enjoy hearing your thoughts and feedback!

Warm regards,

Cota Capital Team