Feb 2025

As we move through the early part of 2025, we’re excited to share perspectives on the trends and shifts in U.S. Early-Stage, Net New Enterprise Technology. We encourage you to explore our key insights below, along with notable updates from our portfolio companies.

View from the Top: Key Trends and Insights

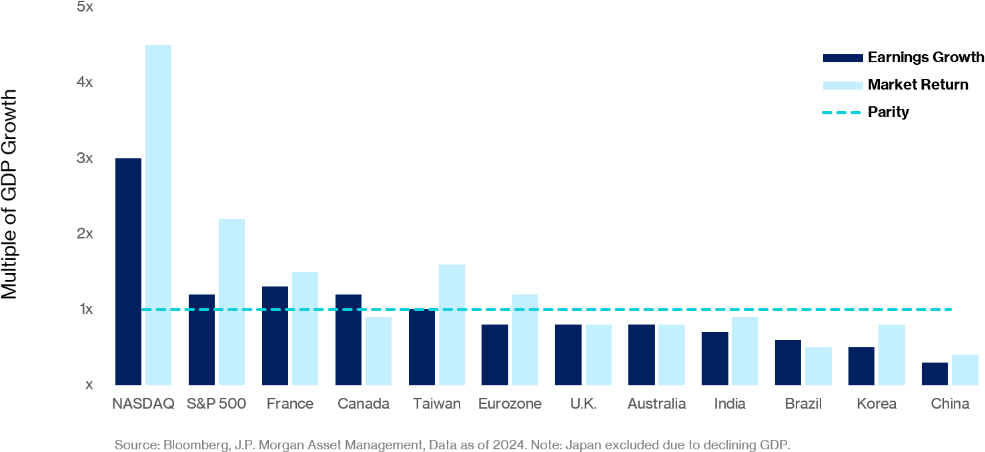

Earnings & Market Returns vs. GDP Growth (2010-2024)

Looking at the data above from 2010 to 2024, the U.S. consistently outperforms other global markets, with both earnings growth and market returns far surpassing GDP growth. This reinforces our view that the U.S. remains the best place for tech businesses to thrive, driven by unmatched talent, capital, and infrastructure.

While emerging markets have historically benefited from lower interest rates, challenges like China’s consumer confidence crisis, a deflating property bubble, and trade tensions with the U.S. weigh on growth prospects. Even when emerging market companies deliver strong revenues, shareholder dilution and currency volatility often prevent GDP growth from translating into market returns.

2024 ended with the S&P 500 near all-time highs, having hit new highs 43 times during the year. We expect this trend to continue in 2025, supported by strong growth in technology and other key sectors.

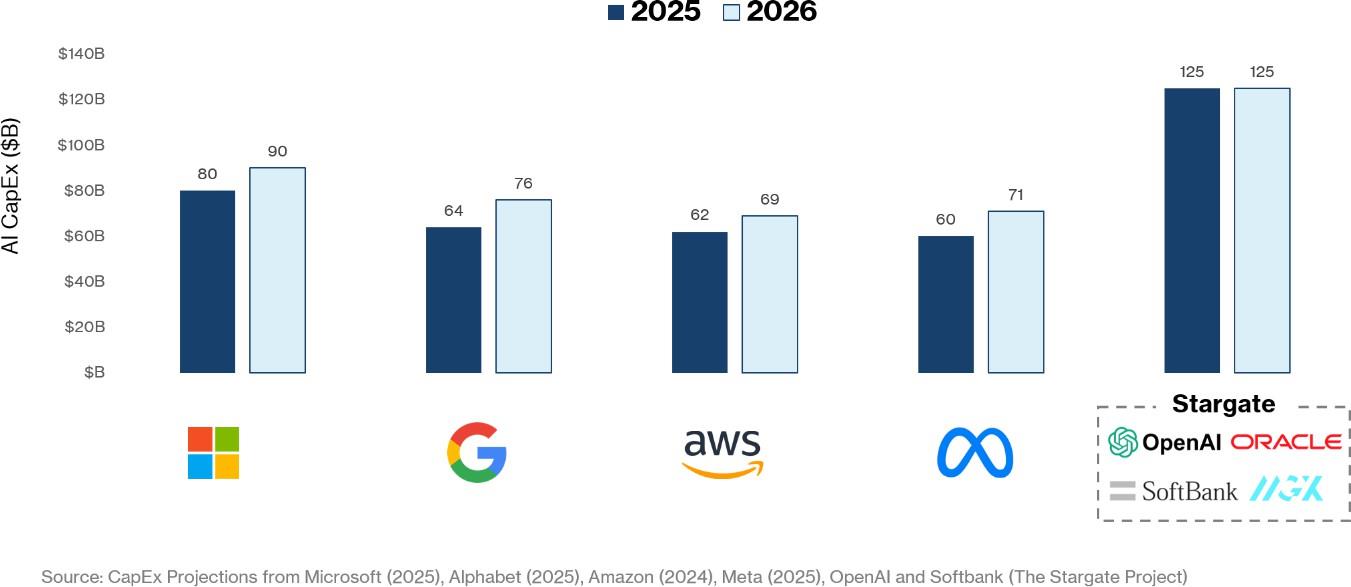

AI Capex is Just Warming Up

Hyperscalers had already committed $200B+ in AI CapEx for 2025 when Project Stargate emerged on January 20th, proposing an additional $500B for data center buildouts over four years. Together, these investments are expected to push annual AI infrastructure spending to over $325B for at least the next two years.

There has been little to no pushback over the past year on whether this scale of infrastructure spending is truly justified—and, more importantly, when will the returns materialize?

DeepSeek’s R1 release marked a turning point, highlighting growing concerns about AI infrastructure costs that had been quietly building for some time. It was the first real challenge to the hyperscalers’ aggressive investment narrative, forcing Wall Street to address mounting skepticism over the sustainability of massive AI spending that had largely gone unquestioned until now.

However, this challenge was swiftly countered. During their January 29th earnings calls, Microsoft and Meta not only reaffirmed their AI infrastructure commitments, but also doubled down on them, signaling their confidence in the long-term potential of these investments. Mark Zuckerberg went even further, pledging “hundreds of billions” for AI infrastructure in the years ahead.

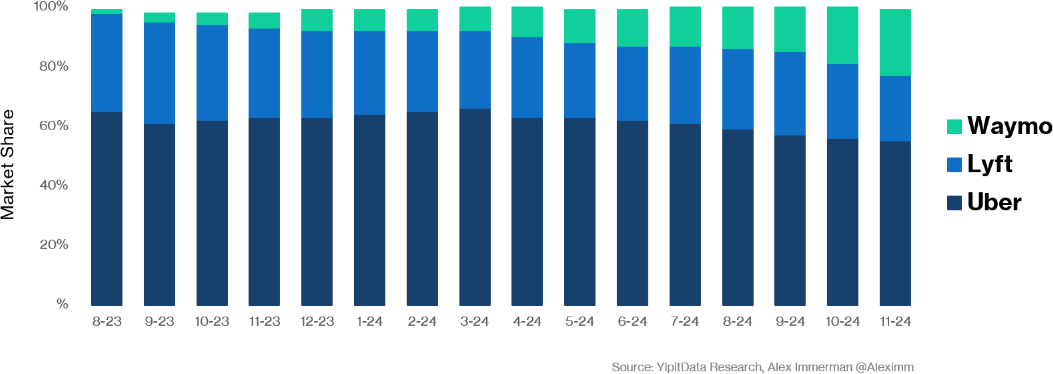

AI Disruption is Real: Waymo

As AI infrastructure continues to grow and evolve, the broader impact of emerging technologies like autonomous vehicles is also becoming evident. In particular, Waymo’s progress in the rideshare market highlights the power of innovation in transforming industries.

Since launching in August 2023, Waymo has captured 22% market share within its operating zone – matching Lyft’s current share and achieving this with just ~300 vehicles. This is just when comparing rides with pickups and drop-offs inside Waymo’s SF operating boundary (excluding any rides to/from the airport). What’s notable is how product quality is driving adoption. Despite longer wait times due to their limited fleet, Waymo is winning riders over with a superior experience – consistently clean vehicles, smooth rides, and quiet trips.

Perhaps more intriguing: rideshare currently represents only 1-3% of total Vehicle Miles Traveled. With autonomous vehicles’ potential for better unit economics at scale, they could expand beyond traditional rideshare markets – tapping into the much larger pool of vehicle trips that have historically been too expensive or inconvenient to serve.

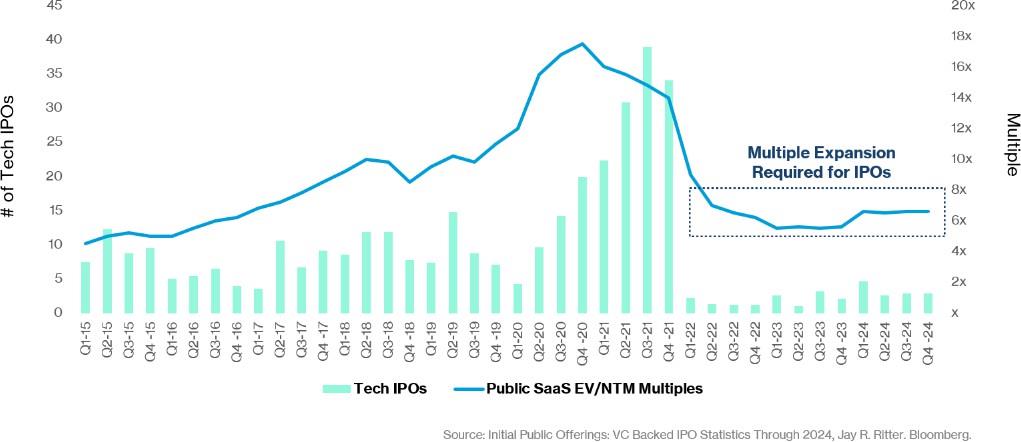

EV/NTM Multiples Dictate IPO Volume

Despite public markets hitting new highs and risk appetite surging (just look at meme stocks and crypto), VC-backed IPO volume remains stubbornly low. The ‘IPO window is closed’ narrative misses the point – this isn’t about market liquidity. It’s about a valuation standoff.

Private companies that raised at 2021’s peak multiples are unwilling to accept current public market pricing, which would mean valuations 30-50% below their last private rounds. While banks point to a mid-2025 IPO surge, the real question is whether companies and investors will finally accept what the market is willing to pay.

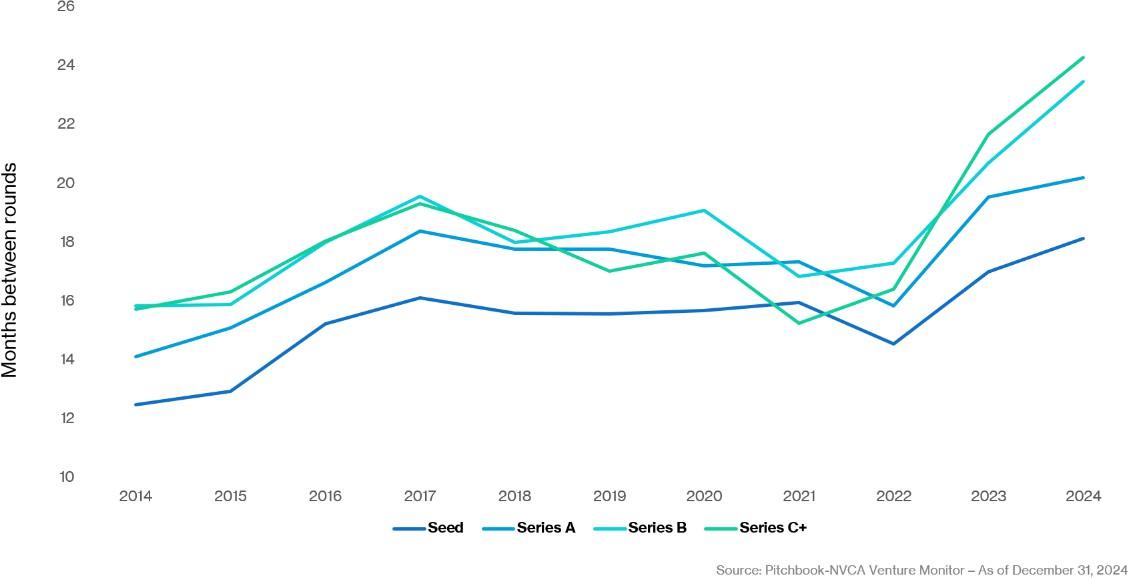

Private for Longer

This valuation standoff is having ripple effects across private markets. Technology companies that went public in 2024 had a median age of 17 years – a reflection of companies staying private longer than ever. But it’s not just about delaying IPOs; the entire funding cycle has slowed.

The time between funding rounds has hit 10-year highs across all stages, with Series C+ companies now taking 24 months to close their next round – 8 months longer than pre-pandemic averages. This doesn’t appear to be a temporary spike: there are now ~60,000 U.S. VC-backed companies (an all-time high) competing for capital while venture firms are raising their own funds at a slower pace. This record inventory of companies allows investors to be highly selective with which deals they back and has created an extremely competitive environment.

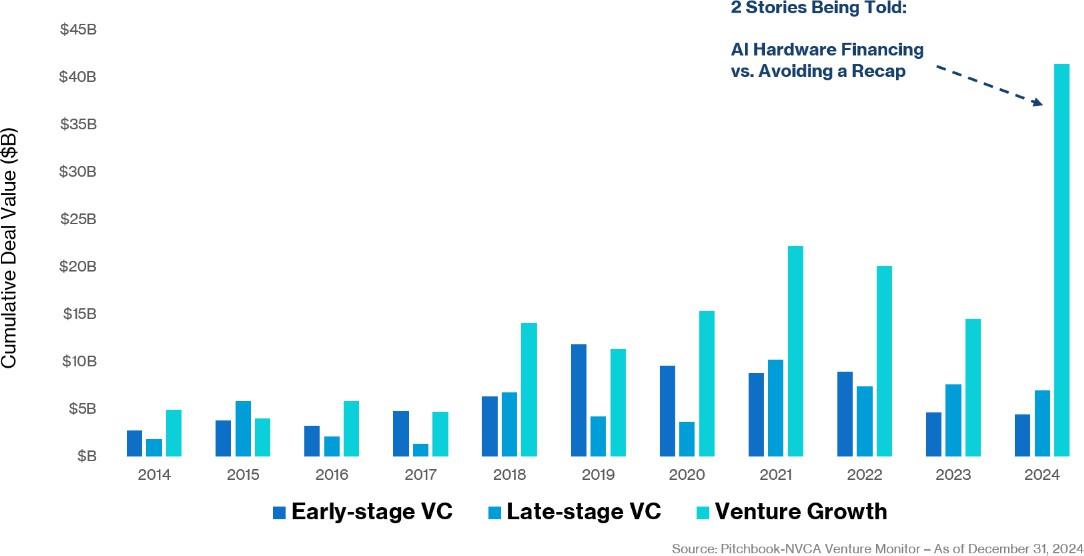

Interest Payments > Valuation Reset

In 2024, growth-stage companies pushed venture debt past $50B in cumulative deal value, the most of any year, with two distinct trends emerging. On one side, AI companies are leveraging debt to fund chip and infrastructure purchases. On the other, many companies unable to secure M&A or IPOs are turning to debt as a way to delay an inevitable valuation reset. While these companies remain solid, many raised their last round at frothy $1B+ valuations with limited revenue, now opting for interest payments over a highly dilutive recap round.

Portfolio Company Milestones

Several Cota portfolio companies have achieved notable milestones that we’re excited to share. We encourage you to explore these updates further:

- Seraphic Security secured a $29 million Series A funding round to accelerate the roadmap for its enterprise browser security platform and market expansion in North America and EMEA.

- Savant Labs closed a $18.5 million Series A funding round to accelerate the development of its AI-powered analytics automation platform that replaces outdated, on-premise analytics tools with secure, cloud-based AI automation that eliminates manual processes and speeds up decision-making.

- Across AI secured seed funding and aims to transform enterprise sales with next-generation agentic memory.

- First Connect closed a strategic growth equity investment enabling First Connect to accelerate product growth, expand market penetration, and continue its efforts to be an industry-leading insurtech platform.

- Qu POS announced record-breaking 2024 results and triple-digit recurring revenue growth.

- CAST AI launched AI Enabler, an innovative optimization tool that streamlines the deployment of large language models (LLMs) and drastically reduces operational expenses.

Emerging Net New Technologies

At Cota, we’re constantly exploring the intersection of technology and its broader impact on industries. Some of the areas we’re focused on are AI tooling and Robotics.

AI Tooling: Hacking the Hackers as AI Redefines Cybersecurity

AI tools are crucial for supporting the entire AI lifecycle, from data preparation and model training to deployment and monitoring, enabling the creation of AI applications efficiently and effectively. In this article, we’ll focus on one key area of AI tooling: security and compliance. These are the AI tools that can be used to build guardrails for protecting large language models (LLMs) from external attacks and misuse. They’re also the tools that help enforce security policies, detect and mitigate risks, and better secure data and systems.

Robotics: Why Software Will Drive the Next Era of Warehouse Robotics

The past decade has brought a dramatic democratization of robotic hardware. With component-level hardware advances slowing down, the next wave of innovation in industrial robotics will happen in software. Indeed, advances in machine vision and AI algorithms are now outpacing hardware improvements, enabling robots to make more informed decisions and execute tasks with greater efficiency and accuracy.

To learn more, please visit us at cotacapital.com.

We would enjoy hearing your thoughts and feedback!

Warm regards,

Cota Capital Team

© 2025 Cota Capital, All rights reserved.

Cota Capital Management, LLC · 555 Mission St Ste 1800 · San Francisco, CA 94105 · USA

Connect with Us

We are always eager to meet and partner with visionary founders and management teams.