By Kevin Jacques, Partner at Cota Capital

A number of market experts and influential allocators have recently posted analyses advocating investment into emerging fund managers. Indeed, studies like this one show that over the past decade, emerging managers and smaller funds have been more likely to drive higher returns for LP investors than their larger counterparts.

As an emerging (but also highly experienced) manager myself, I’m delighted to see this love for my brethren. But I’d like to offer a proviso. My two-plus decades of investing across three venture market cycles tell me that conditions have shifted, and we have entered a new phase of the venture cycle. If history repeats, and it very often does, the emerging manager skills that will drive strong returns for the next several years will be very different from what drove returns over the last decade. Allocators should know this if they want to maintain performance.

Let me elaborate. Many allocators who have supported emerging managers since 2013 or 2014 have enjoyed strong returns. But the reason for the outperformance of those emerging managers is not just that they were hungrier or had more relevant networks. The reason is that most emerging funds were seed stage focused.

Why is this important? Because over the past decade, seed stage companies and seed stage investors benefited from a number of cyclical tailwinds. First and foremost, a well-capitalized, if not over-capitalized, venture follow-on financing environment led to a higher percentage of seeded companies raising follow-on rounds at relatively high valuations. As a result, the batting average for many seed stage investors became inflated. The higher follow-on valuations also delivered generous step-ups and large paper gains.

The very best and most experienced emerging GPs recognized this inflation and steered some of their portfolios to seek exits before the cycle turned. But many did not, leaving their funds with low DPI and TVPI metrics that now seem shaky as market valuations continue to reset.

LPs who pursued an “index of venture capital” strategy and spread their allocations across a broad number of emerging manager GPs benefited from the aforementioned tailwinds. The strength of the tailwind caused many allocators to seek out emerging managers with “hot” deal sourcing networks. Access or sourcing alone became the most highly prized virtue.

So, what’s changing?

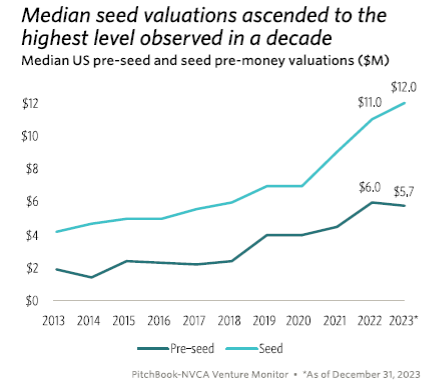

A lot is changing. We have clearly entered a new phase of the venture cycle. Rising interest rates and less capital have turned tailwinds into headwinds. Paradoxically, however, seed stage valuations have continued to rise. Data from the Pitchbook-NVCA Monitor shows that median pre-seed and seed stage valuations have tripled over the past 10 years. In other words, a typical dollar invested into a seed round today would buy just one-third of the ownership it would have in 2013.

Source: Pitchbook NVCA Venture Monitor Q4 2023 Report

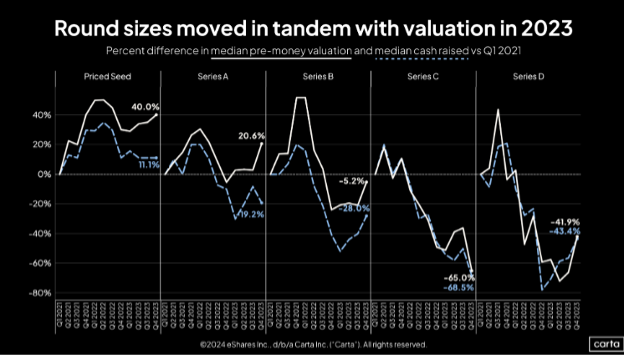

Seed stage and later stage valuations are decoupling. While later stage valuations began to reset in late 2021, seed stage valuations have continued to climb to all-time highs.

Source: Carta Research Blog

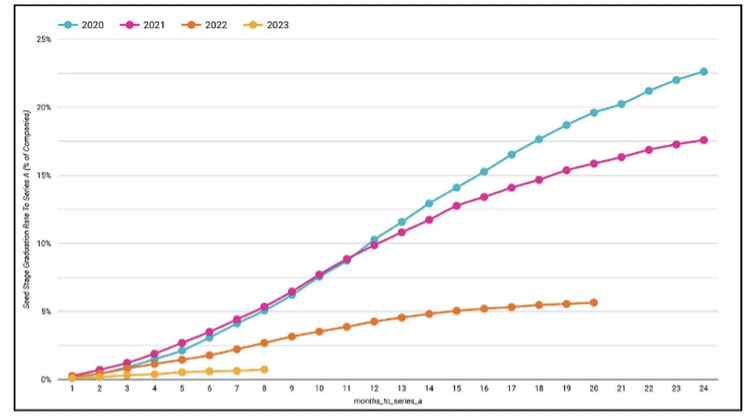

One result of the decoupling of early stage and later stage valuations has been a significant drop in the percentage of seed stage companies that successfully raise follow-on rounds. The market data also suggests that for the companies that do raise a Series A, the time between seed and Series A is significantly greater today than in 2021.

Follow On From Seed Taking Longer; Fewer Companies Successfully Raising

Source: Crunchbase on LinkedIn

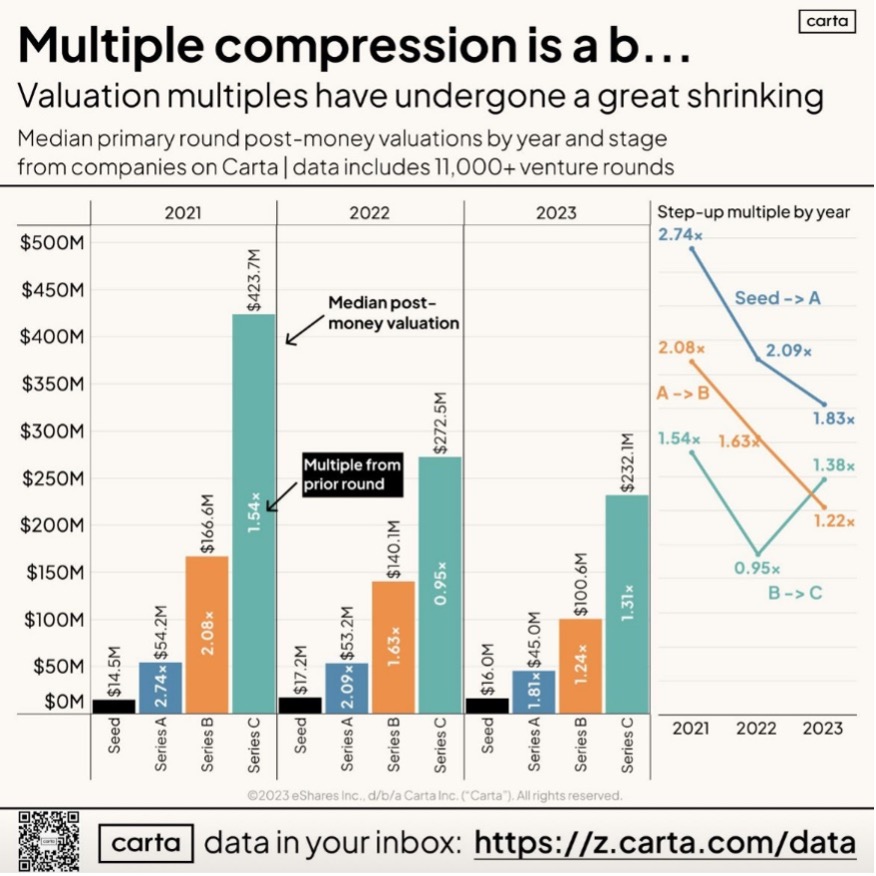

Another important impact of the decoupling is a significant decline in valuation step-ups for follow-on financings. According to Carta, the valuation step-up a typical seed stage company achieves upon raising a Series A has fallen by almost one-third since 2021. For seed stage-focused GPs, this means both batting average and the step-up for hits are dropping to levels more in line with long-run averages.

Source: Carta Research via LinkedIn

What GP qualities will drive returns for the next several years?

A rising tide will no longer float most seed stage boats. So how can allocators adjust? I remain optimistic that GPs with smaller, focused funds will continue to outperform in a more challenging market. In particular, in an environment with fewer IPOs and fewer outsized acquisitions, funds investing in smaller rounds, at more rational valuations into companies able to achieve efficient growth are more likely to achieve healthy exit multiples.

In the new venture market environment, it’s fair to ask what GP qualities will drive returns in this new environment. I believe the performance of top GPs over the next few years will be driven by a very different set of skills.

To re-use the floating boat metaphor, allocators might want to consider GPs who have the experience and ability to help their portfolio companies or “boats” navigate a more turbulent market. Strong portfolio batting averages and strong exit multiples will not come easily with the current market headwinds or the ebbing valuation tide. In today’s market, they will need to be earned through thoughtful deal selection, skill and experience.

Which GPs should allocators favor?

In the current market where tailwinds have become headwinds, I believe that GPs with a more balanced set of skills will be better able to help their portfolios navigate to good outcomes and will be more likely to deliver above-average returns. Allocators might want to consider:

- GPs with deep domain experience vs. generalists. Their relationships, and ecosystem expertise can help portfolio companies grow in partnership with incumbents or be acquired by incumbents. In an era of tighter capital, fewer startups will be able to disrupt the ecosystem. Most will have to work within the ecosystem.

- GPs with deep board of director and operational experience, who will be better equipped to coach their companies towards efficient growth.

- GPs who truly understand “financing risk” and are able to carefully balance factors including cash burn vs. syndicate reserves vs. milestone achievement in a period of capital scarcity. GPs who have successfully guided portfolio companies through prior venture cycles will likely have a distinct advantage in managing financing risk vs. investors experiencing their first venture cycle.

- GPs who are focused on less capital-intensive companies and business models. The ZIRP (zero interest rate policy) environment that emboldened investors to pursue opportunities with very high capital needs has clearly passed. With interest rates returning to historical levels, capital efficiency is once again all-important.

The market data makes a strong case that success for emerging GPs in the coming years will be determined by a different set of skills and strategies. As we leave behind an era of easy capital, GPs must adapt accordingly if they want to thrive in a more discerning market environment.